The IFRS Foundation has announced the establishment of the International Sustainability Standards Board, which will develop global sustainability disclosure standards within the next year. Prototypes released by the IFRS Foundation suggest that the new standards will incorporate principles that have guided ESG reporting for several years. They provide a clear direction for businesses, who can prepare for the new standards by completing a double materiality assessment, developing value creation models, and formalizing sustainability-related governance.

On 3 November 2021, the IFRS Foundation announced the establishment of the International Sustainability Standards Board (ISSB). The new ISSB intends to develop a comprehensive global baseline of sustainability disclosure standards to meet investors’ information needs.

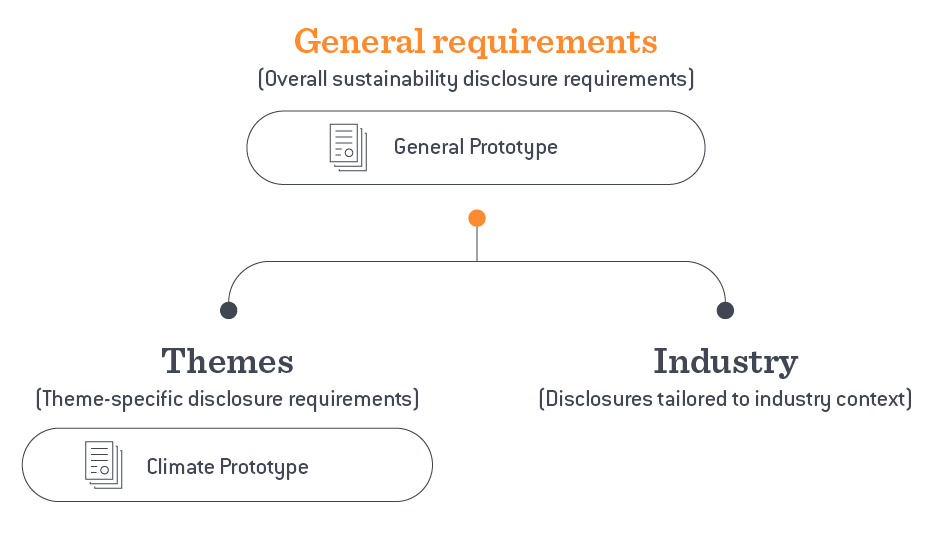

The IFRS Foundation has released two prototype documents, one for climate and another for general ESG disclosures:

- The Climate-related Disclosures Prototype (Climate Prototype) informs reporting standards for the identification, measurement and disclosure of climate-related financial information.

- The General Requirements for Disclosure of Sustainability-related Financial Information Prototype (General Prototype) informs overall requirements for the disclosure of relevant sustainability-related financial information. It will be supported by separate standards for specific industries and for specific ESG themes (such as climate change, as per the Climate Prototype).

The following analysis focuses on the General Prototype, which will guide sustainability disclosure standards across industries and sustainability topics.

The General Prototype builds on the established work of various global standards setters, weaving in elements from frameworks like the TCFD and the Integrated Reporting Framework. It should thus be seen as a consolidation of existing voluntary frameworks that have worked well, as opposed to the creation of new guidance.

BWD’s review of the General Prototype suggests three focus areas for businesses who want to prepare for the forthcoming standards over the next year:

- Clarifying materiality

- Developing a value creation model

- Getting governance sorted

Clarifying materiality

Alignment with the General Prototype will require a materiality assessment, which helps management to “identify the information about sustainability risks and opportunities and the associated metrics that are material to an entity’s circumstances” (Paragraph 14 of the General Prototype).

When it comes to identifying which sustainability-related matters are material, the General Prototype asks businesses to:

- Consider external impacts, then effects on enterprise value. The materiality assessment process should focus on how environmental or social impacts may affect future cash flows, and thus the entity’s enterprise value (Paragraph IN3)

- Identify common information needs. At its core, materiality is about understanding and meeting the information needs of report users. Appendix C defines three types of “primary users” for financial reporting — investors, lenders, and creditors. Organizations should engage each of these groups to identify their “common information needs”, and then ensure that the report meets these needs

- Materiality is dynamic and should be reviewed annually. “Because an entity’s circumstances change over time, materiality judgements [should be] reassessed at each reporting date in the light of those changed circumstances” (Paragraph 14)

Given this guidance, a company can align with the General Prototype by:

- Identifying its impacts on society and the environment

- Considering how these impacts affect enterprise value — ensuring to engage investors, lenders, and creditors to understand “common information needs”

- With steps 1 and 2 complete, a business can identify the sustainability-related risks and opportunities that could influence report users’ assessment of enterprise value — thus meeting the intent of the General Prototype

- Conducting a materiality assessment annually

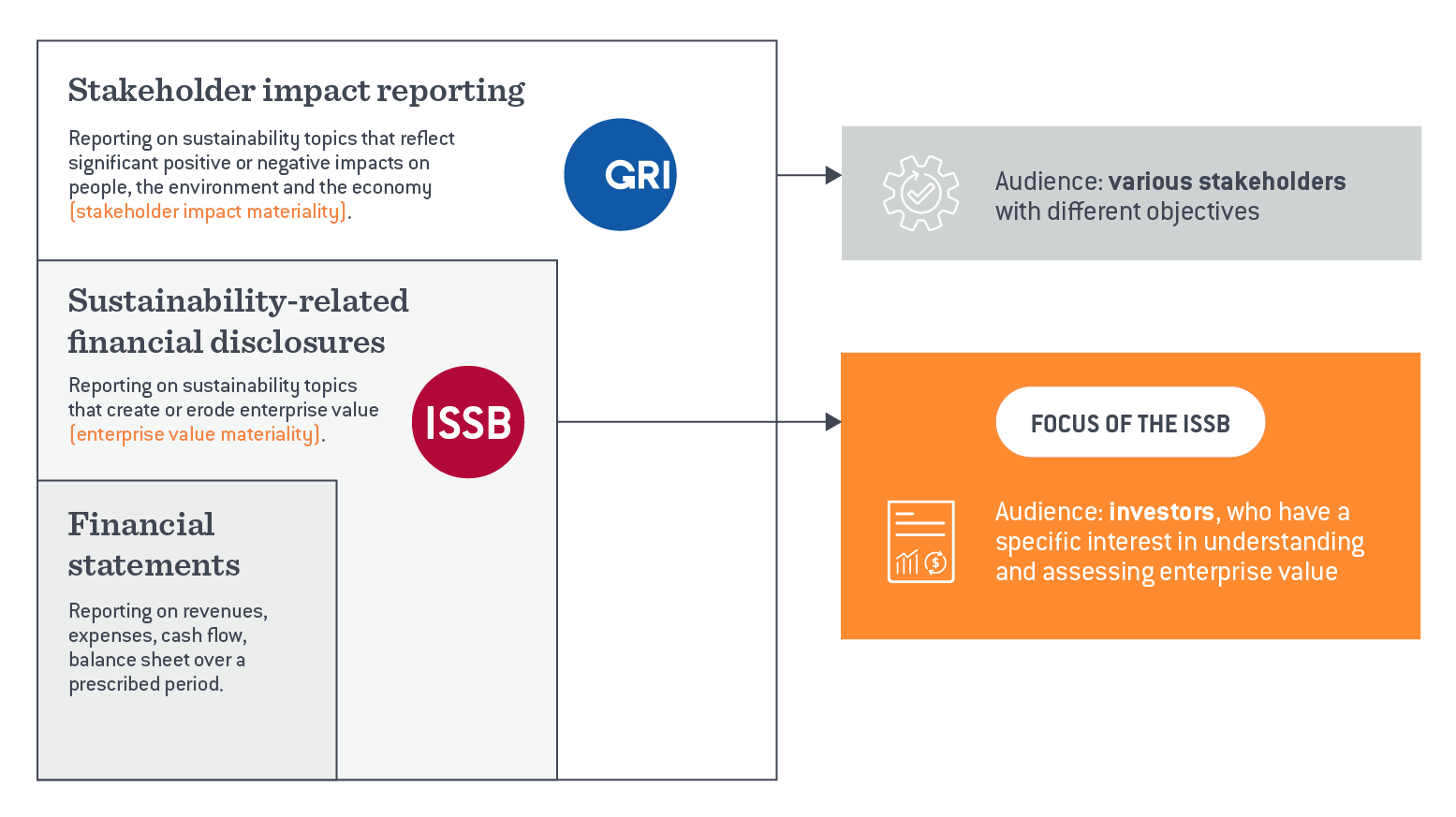

Readers familiar with the developing ESG reporting landscape will recognise the concept of double materiality in the process defined above. Double materiality recommends a business consider both its external impacts on society and the environment and the ESG topics which affect enterprise value.

Considering materiality from both an external impact and enterprise value perspective is compatible with the ISSB guidance, so long as an ISSB-aligned “general purpose financial report” focuses on those sustainability-related matters deemed material from an enterprise value perspective.

The compatibility of double materiality with the ISSB guidance was underscored by Professor Bob Eccles, who stated that “nothing in the ISSB’s standards will prevent companies from reporting on additional sustainability matters that, for whatever reason, are not material to investors.” Reporting on these additional sustainability matters would be contained in other “disclosures to stakeholders about sustainability matters that have impacts on people, the environment and the economy” (Paragraph IN2).

A comprehensive materiality assessment also has strategic value, furthering its alignment with the General Prototype. For example, one of the strategy disclosure requirements in the Prototype asks for “a description of the processes in place to identify significant sustainability-related risks and opportunities that [a company] reasonably expects could positively or negatively affect [its] business model, strategy, and cash flows” (Paragraph 28a). A comprehensive double materiality assessment serves as this process, and its strategic insights can be illustrated in the report using value creation models.

Developing a value creation model

Reporting which visualizes how a business creates value generally receives top marks from investors. A recent review of reporting practices from across the globe noted that visualizations are “key to the reader’s understanding of relationships” and can “facilitate the connection of information.”

Developing a value creation model is one of the best tools at your disposal for showing investors and others how your sustainability efforts align with broader business strategy. It will also help you meet the requirements of the General Prototype by:

- articulating how sustainability-related risks and opportunities impact the business model (Paragraph 27a)

- describing the current and anticipated effects of sustainability-related risks and opportunities on your value chain (Paragraph 30a)

- identifying where in the value chain significant sustainability-related risks and opportunities are concentrated (geographic areas, facilities or types of assets, inputs, outputs, or distribution channels) (Paragraph 30b)

Connectivity between sustainability and financial reporting

The Integrated Reporting Framework is a good place to start when considering a value creation model for your business. In particular, page 22 of the Framework provides a template that many organizations have used to illustrate how they rely on various types of capital to create both financial and nonfinancial value.

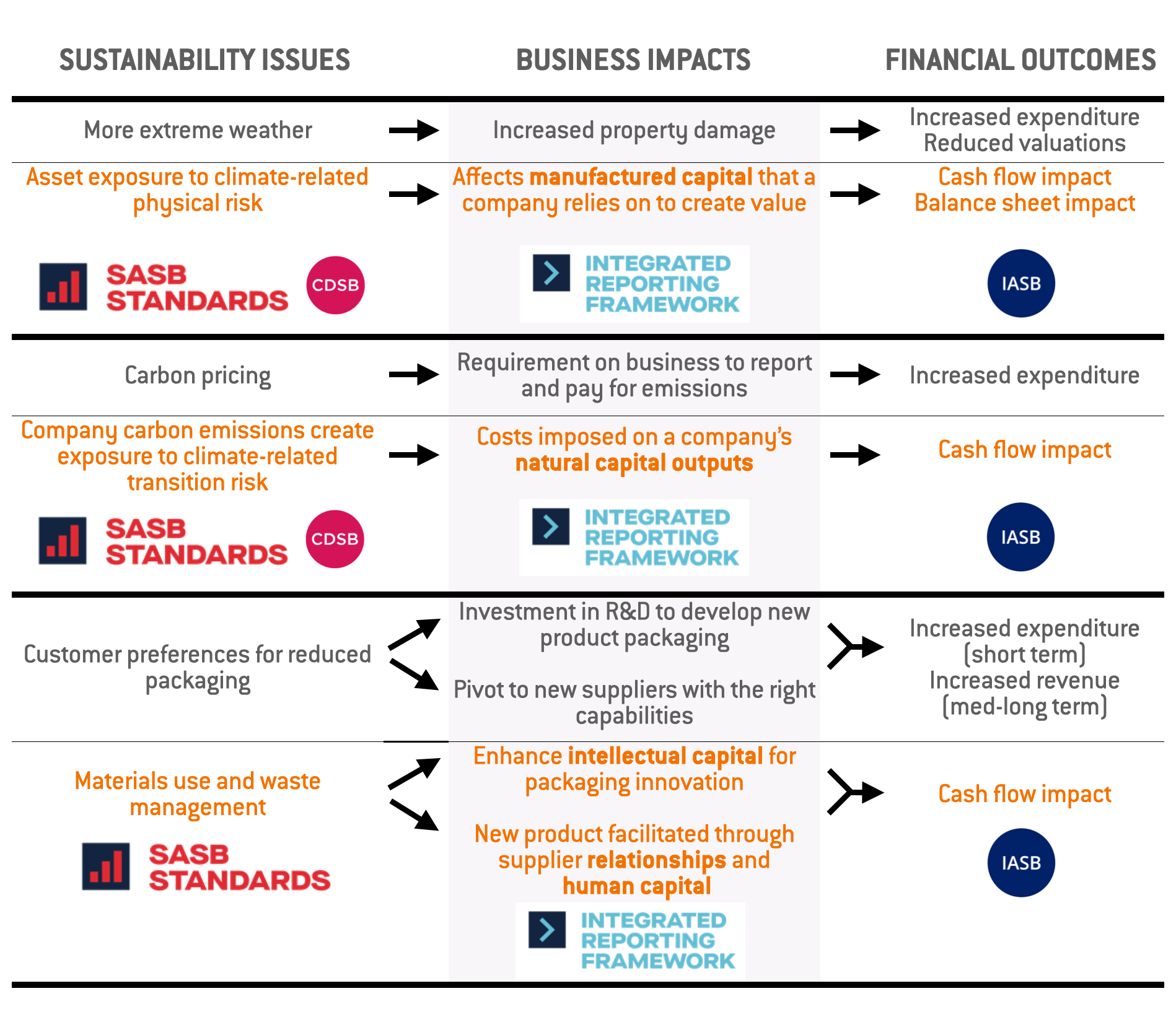

The Integrated Reporting Framework is part of the Value Reporting Foundation, which is set to be consolidated into the ISSB by June 2022, placing integrated reporting at the foundation of the new standards. A key focus for the ISSB will be using integrated reporting principles to establish connectivity between sustainability-related financial reporting and financial outcomes as reported in traditional financial statements. In fact, the General Prototype asks that businesses qualitatively disclose how sustainability issues affect financial performance, position and cash flows (Paragraph 32).

Value creation models can help businesses define financial impact pathways that demonstrate the connectivity between sustainability issues and financial performance. Three indicative financial impact pathways are shown below. The top row of each example has a plain English description of how a sustainability issue results in a financial outcome. The bottom row of each example shows how it can be represented using sustainability disclosure and financial accounting standards, with the Integrated Reporting Framework acting as a bridge that categorizes how each sustainability issue impacts enterprise value creation (and thus financial outcomes).

Getting governance sorted

The General Prototype asks companies to disclose the governance processes, controls and procedures they use to monitor and manage sustainability-related risks and opportunities. Governance disclosures relate to:

- The board, committee, or equivalent body with oversight of existing and emerging sustainability-related risks and opportunities

- Management’s role with respect to existing and emerging sustainability-related risks and opportunities

Paragraph 25 provides a list of disclosure requirements that effectively double as best practice recommendations, summarized in the table below.

| Board recommendations | Management recommendations |

| Create a board/committee with responsibility for sustainability matters (25a), with clear terms of reference (25b) and the right skillset (25c) | Include sustainability-related performance metrics into remuneration outcomes (25f) |

| Establish processes to ensure the board/committee is informed on sustainability matters (25d), and considers these matters during strategic deliberation (25e) | Integrate clear roles and responsibilities into management regarding sustainability matters (25g) |

| Ensure the board/committee oversees sustainability-related targets and process (25f) | Establish appropriate controls for management to monitor sustainability matters (25g) |

| Ensure the board/committee incorporates sustainability-related performance metrics into remuneration policies (25f) | Ensure sustainability matters are properly coordinated across different internal functions (25g) |

Governance mechanisms should cover all of an organization’s material sustainability-related risks and opportunities. Although the General Prototype says that companies shall disclose the governance arrangements for each of its material sustainability-related risks and opportunities, it also says the company shall avoid unnecessary duplication. For example, “when an entity’s oversight of sustainability-related risks and opportunities is managed on an integrated basis, the disclosures on governance should also be integrated rather than providing separate governance disclosures for each significant sustainability risk and opportunity.

Conclusion

In the first half of 2022, the ISSB is expected to release an exposure draft of sustainability disclosure standards based on the General Prototype. Following public consultation on the exposure draft, the standards could be finalized by the second half of 2022.

The principles outlined above have underpinned the best practice integration of ESG into corporate reporting for several years. Their inclusion in the General Prototype is a welcome sign of continuity, and provides clear direction for those charged with managing the reporting process. The time between now and the confirmation of ISSB’s official sustainability disclosure standards, therefore, should not be seen as a time to wait and see what may come. Instead, companies can hit the ground running by using the year ahead to confirm their sustainability-related matters through a double materiality process, to use value creation models to describe how sustainability impacts their business models, and to formalize their sustainability-related governance.

The author thanks Gib Hedstrom of ESG Navigator, as well as BWD Strategic colleagues for their review and improvements to this article.