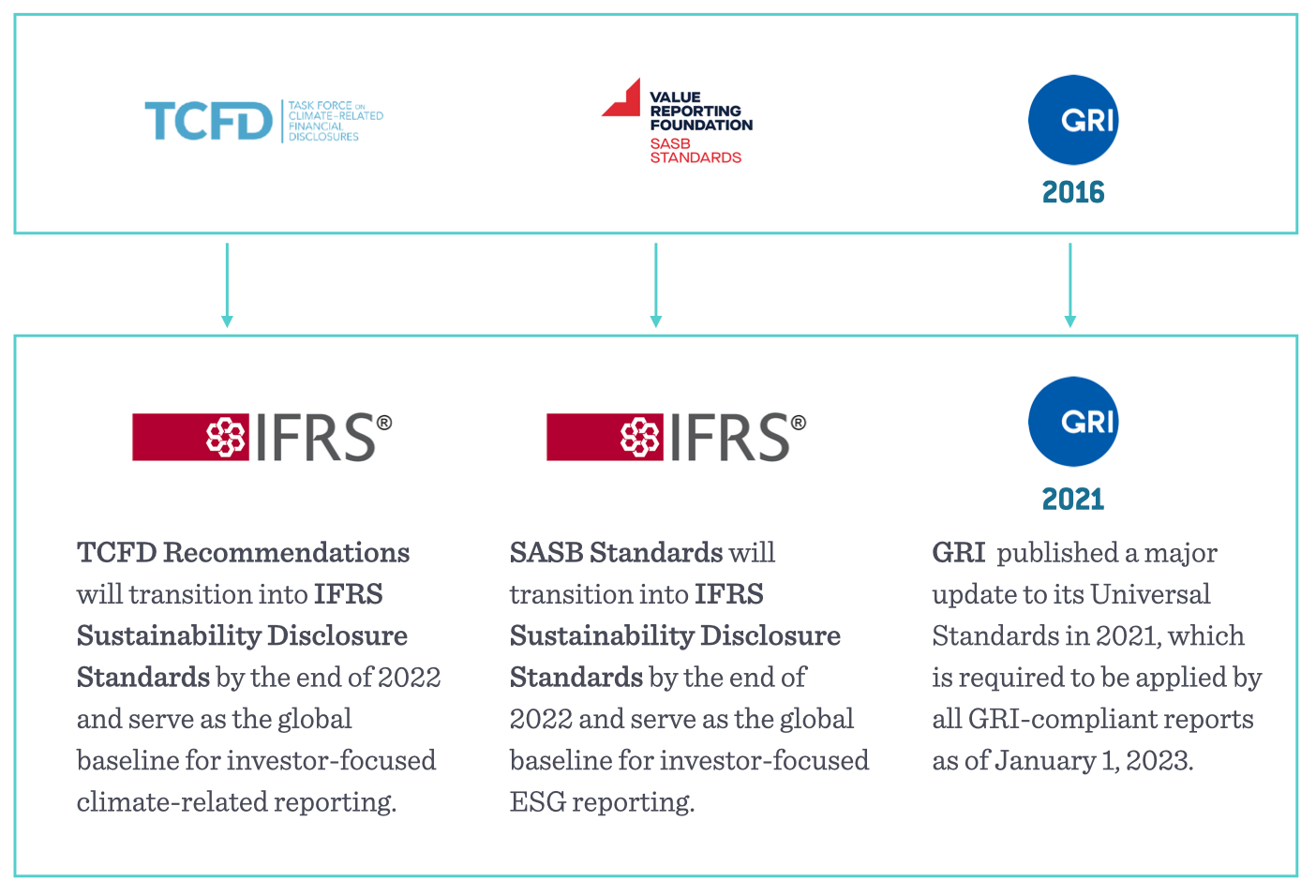

If you report using TCFD, SASB, and/or GRI, you will need to make changes to your reporting to remain aligned with these standards:

- TCFD reporters will need to transition to align with the proposed IFRS S2 Climate-related Disclosures Standard

- SASB reporters will need to transition to align with the proposed IFRS Sustainability Disclosure Standards

- Companies reporting “in accordance” with the GRI Standards will need to apply the new GRI Universal Standards

Global ESG reporting standards are converging on a two-pillar reporting system that encourages corporate reporting on:

- How ESG issues affect enterprise value (financial materiality pillar): the IFRS Foundation is developing IFRS Sustainability Disclosure Standards to guide reporting on this pillar, which applies to investor-focused reporting. The proposed IFRS standards rely on, and will likely replace, the SASB Standards and TCFD Recommendations (among other existing frameworks guiding investor-focused sustainability disclosure).

- How companies impact external environmental and social outcomes (impact materiality pillar): the GRI Standards remain the most applicable standards for this pillar, which applies to multi-stakeholder reporting focused on sustainable development. In late 2021, the GRI affirmed the use of the GRI Standards as an impact reporting tool through a comprehensive update to the GRI Universal Standards.

We have been tracking these developments in our ESG standards timeline.

The convergence means that TCFD and SASB reporters will need to move toward adopting the IFRS Sustainability Disclosure Standards. GRI reporters will need to ensure that their reporting aligns with GRI’s comprehensive Universal Standards update. The rest of this article steps through how TCFD, SASB, and GRI disclosures will need to evolve for companies to maintain alignment into the future.

From TCFD to the IFRS standards

The TCFD Recommendations will evolve into the proposed IFRS S2 Climate-related Disclosures Standard.

The proposed IFRS S2 Climate-related Disclosures Standard retains the familiar Governance-Strategy-Risk Management-Metrics and Targets categorization of the 2017 TCFD Recommendations. At the same time, some of the key additional requirements of IFRS S2 include:

- disclosures such as how climate is included in board mandates, existence of climate-related skills/capabilities, and whether dedicated controls are applied to climate-related issues (within Governance)

- more granularity on climate-related resourcing plans and expected changes in financial position and performance over time (within Strategy)

- requirement to disclose a transition plan, including emissions reduction targets and use of offsets (within Strategy)

- details of the company’s resilience assessment and capacity to adjust strategy over time (within Strategy)

- industry-specific climate-related metrics based on the SASB Standards (within Metrics and Targets)

- cross-industry metrics (within Metrics and Targets, see below for additional discussion on cross-industry metrics)

- whether the emissions target is validated and used a sectoral decarbonization approach (within Metrics and Targets)

The above list is not exhaustive. The IFRS Foundation has published a detailed comparison of its proposed standard with the TCFD Recommendations.

Cross-industry metrics

A key difference with the 2017 TCFD Recommendations is the requirement to disclose cross-industry metrics including:

- Scope 1, 2, and 3 emissions

- Amount and percentage of assets or business activities vulnerable to transition risks

- Amount and percentage of assets or business activities vulnerable to physical risks

- Amount and percentage of assets or business activities aligned with climate-related opportunities

- Amount of capital expenditure, financing or investment deployed towards climate-related risks and opportunities

- Internal carbon prices

- Links between climate and executive remuneration

These cross-industry metrics may not be familiar to some TCFD reporters because they were not defined within the original TCFD Recommendations. Instead, they were defined within the October 2021 TCFD Guidance on Metrics, Targets, and Transition Plans. In addition to information on cross-industry metrics, the October 2021 guidance goes into more detail on transition plans and estimating financial impacts – all of which are important for maintaining alignment with future climate-related disclosure expectations.

Some insight into the convergence

Although the TCFD is not formally consolidating into the IFRS Foundation, a senior member involved in the consolidation mentioned at a recent conference panel that “the TCFD will fade away”. While such a move has not been confirmed, the TCFD has been actively involved in IFRS Technical Readiness Working Groups to assist in developing the IFRS Sustainability Disclosure Standards. The TCFD has published information on the alignment between its 2017 Recommendations and the proposed IFRS S2 Climate-related Disclosures Standard – suggesting that the IFRS standards are likely to emerge as the new global standard (as opposed to a new standard that will compete with TCFD).

From SASB to the IFRS standards

The SASB Standards are consolidating into the IFRS Foundation in mid-2022. The SASB Standards will transition into IFRS Sustainability Disclosure Standards in two key ways:

- the SASB Standards will inform industry-specific disclosure requirements within IFRS Sustainability Disclosure Standards (Appendix B of the aforementioned IFRS S2 Climate-related Disclosures standard is an example of this)

- the SASB Standards will act as IFRS implementation guidance as the new IFRS standards are developed

The proposed IFRS S1 IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information Standard (General Requirements Standard) indicates how the SASB Standards could be used as implementation guidance. At the time of writing, the IFRS S1 General Requirements Standard is the standard that organizations would use to report on sustainability-related risks or opportunities other than climate.

Organizations applying the General Requirements Standard would need to:

- Consider the disclosure topics in the industry-based SASB Standards when identifying sustainability-related risks and opportunities

- Consider the metrics within the industry-based SASB Standards when identifying investor-focused disclosures for specific sustainability-related risks or opportunities

The SASB Standards are just a starting point, however, as the IFRS S1 General Requirements Standard also directs organizations to consider:

- ISSB non-mandatory guidance such as the CDSB guidance for water– and biodiversity-related disclosures

- Sustainability-related risks, opportunities, and related metrics used by peers in the same industry or jurisdiction

- Guidance from other investor-focused standards-setters

Another area where the General Requirements Standard expands on SASB is by incorporating guidance from the International Integrated Reporting Framework (which is also consolidating into the IFRS Foundation). This guidance suggests that a company’s sustainability-related risks and opportunities:

- Relate to the organization’s dependencies/impacts on resources and stakeholder relationships

- Are relevant across an organization’s value chain, potentially affecting inputs, business activities, outputs, and outcomes

What does this all mean for SASB reporters?

Companies can still use the SASB Standards in the short term. However, the impending consolidation of the SASB Standards into the IFRS Foundation means that companies need to start thinking about how to eventually shift their “SASB-aligned disclosure” to an “IFRS-aligned disclosure”. This will require more than a simple search-and-replace of “SASB” with “IFRS”, as the proposed IFRS standards expand on the SASB Standards through:

- Requiring disclosure on how sustainability-related risks and opportunities affect the organization’s business model, including its value chain

- Incorporating other frameworks not used by many SASB reporters, such as the CDSB guidance on water- and biodiversity-related disclosures

From GRI 2016 to GRI 2021

The GRI issued an update to its Universal Standards in late 2021. Reports published from January 1, 2023 will need to align with the new Universal Standards in order to remain in accordance with the GRI Standards.

Some of the key changes for GRI reporters to consider include:

- No more matrix – GRI now recommends reporting a list of material topics, rather than displaying them according to a matrix

- No more core – GRI has removed the “Core” option that allowed organizations to report in accordance with the GRI Standards by choosing a single indicator within each material topic standard. To remain in accordance, organizations must now report against all indicators within a material topic standard, or provide a reason why a disclosure is not applicable (GRI provides a list of permitted reasons that organizations must use).

- More human rights – Consistent with GRI’s push to position itself as the “only credible partner” for multi-stakeholder impact reporting, impacts on human rights are now a required reporting topic. Key human rights reporting requirements that now form part of the Universal Standards include:

- Impacts on human rights must be considered as part of determining materiality, and material topics should be considered/approved by the company’s board (or highest governing body)

- Descriptions of specific policy commitments on human rights

- Descriptions of how due diligence and stakeholder engagement processes consider human rights, and how this is overseen by the board and executive

- More workers – Consistent with GRI’s renewed focus on human rights disclosures, the new Universal Standards require organizations to report on the number of workers who are not employees but whose work is controlled by the organization. GRI’s definition of “worker” is broad enough that it likely includes the workforces of supplier organizations that have traditionally been excluded from a company’s sustainability reporting.

GRI has published a comprehensive mapping of the GRI Universal Standards 2021 with the 2016 version (XLSX file download).

Where does GRI sit viz the IFRS?

GRI is not consolidating into the IFRS Foundation, and has not participated in IFRS Technical Readiness Working Groups. This is because the GRI Standards fulfill a different purpose to the proposed IFRS Sustainability Disclosure Standards. While the IFRS is focused on reporting to investors on sustainability-related issues relevant for enterprise value, the GRI is focused on reporting to multiple stakeholders about a business’s impact on sustainable development objectives. Despite the IFRS and GRI Standards remaining separate, the two organizations have agreed to work together to ensure compatibility.

Companies seeking to satisfy both of these reporting objectives are encouraged to adopt the IFRS Sustainability Disclosure Standards and the GRI Standards as part of a comprehensive corporate disclosure.