As the prevalence of sustainable investing grows, organisations are increasingly recognising the value of sustainability (or ESG) reporting as a way of demonstrating their credentials to the market. The market has responded by using reporting to create company ESG ratings that attempt to distil the entirety of a company’s approach and performance into a single metric. How can companies use these ratings to their advantage?

Reporting on sustainability is now commonplace, with many companies producing standalone sustainability reports or integrating ESG content into their statutory reporting (such as through integrated reporting). But the increased prevalence of sustainability reporting hasn’t necessarily made it more coherent. While there’s a proliferation of reporting guidance available for organisations to use, many sustainability reporting frameworks are sub-standard, compliance-focused, and fail to offer strategic value. The lack of clarity on a best-practice approach has been driven by the fact that sustainability reporting remains voluntary for most of the planet, notwithstanding recent suggestions of harmonisation and regulation mooted by several countries.

There’s also the reality that ESG issues will vary in importance across industries. Waste from packaging is important for consumer goods, green building ratings are important for real estate, and financial literacy is a focus for financial services.

The investor with a global investment universe is thus met with a dizzying array of ESG metrics and priorities within corporate disclosure that they have to somehow factor into their decision-making. To help make sense of it all, many investors turn to third-party services that try to standardise corporate reporting and provide insights on organisational performance.

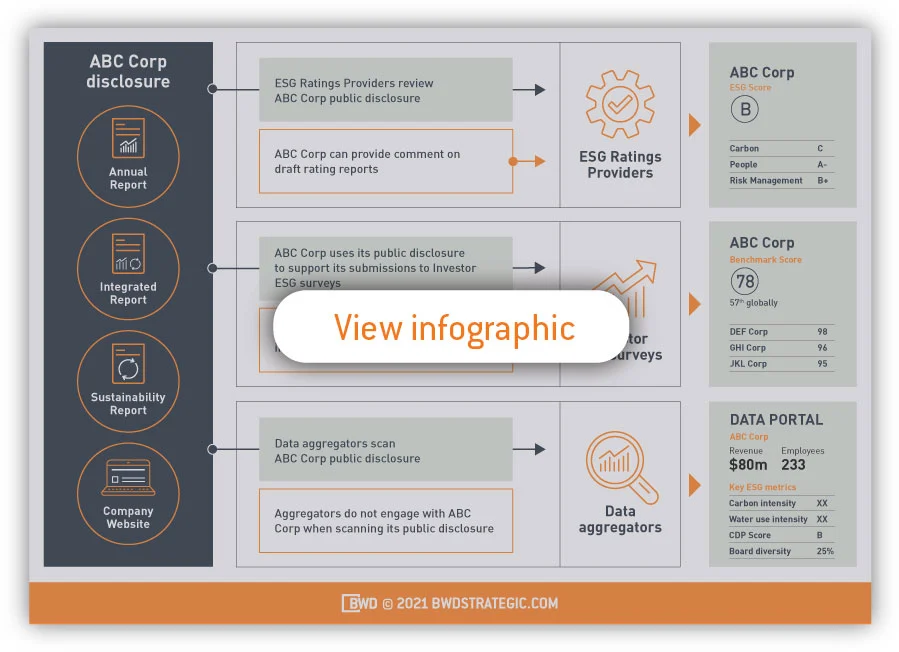

These third-party services generally fall into one of three groups, which I will refer to as:

The infographic below (PDF) summarises how these three groups assess ESG performance based on corporate disclosure. The rest of this article provides advice on how organisations can enhance their ESG ratings through better reporting, as well as more detail on how ESG ratings providers, investor surveys, and data aggregators use corporate disclosure to rate ESG performance.

1. ESG ratings providers

ESG ratings providers are organisations which review a company’s public disclosure and calculate a rating for the company (a score of 0-100, or a rating of A-F) based on a proprietary scoring framework. Examples include Sustainalytics ESG Risk Rating, MSCI ESG Rating, ISS ESG Corporate Rating, FTSE4Good, and the Vigeo Eiris ESG Profile.

While ratings providers don’t rate every company on the planet, if they publish a rating for your company, you can’t get out of it. At the same time, a provider will usually engage with your company during the rating process, but only for the purposes of clarifying the applicability of your existing public disclosure (i.e. they won’t accept information that is not disclosed publicly).

Because these ratings providers rely exclusively on corporate reporting, companies can usually make meaningful gains in their rating simply by improving the comprehensiveness and alignment of what they report. These terms are generic so I will explain how they apply to ratings below.

Comprehensiveness means reporting as much as you can, even if it is disclosed in a sustainability data appendix separate to the annual report (which is a useful way of achieving comprehensiveness in disclosure without overcomplicating the flagship report). For example, you may have never reported on workplace fatalities, because your company is involved in low-risk office work. But to the ratings providers, failing to disclose fatalities (even if it is zero) is seen as lacking transparency and your rating will suffer for it.

Alignment means matching the metrics your company uses to the metrics that the ratings providers are assessing. For example, your company may report on a broad ‘women in management’ figure, while a ratings provider is scoring your company on the percentage of ‘women in executive’ positions. This mismatch can result in the ratings provider simply marking the ‘women in executive’ metric as ‘not disclosed’. Avoiding this is an easy fix. If your company is already reporting on the issue, then the disclosed metric just needs to align better with the ratings providers’ frameworks.

While it would be unrealistic to try to report on every metric requested by every ratings provider, a strategic comparison of existing reporting to the ratings frameworks can uncover opportunities to enhance your company’s standing simply through improving reporting.

2. Investor survey organisations

Investor survey organisations invite companies to respond to surveys (or questionnaires) that they administer, and then score the responses according to a proprietary scoring framework. These surveys are not your friendly SurveyMonkey feedback forms. They are exhaustive diagnostics that require hundreds of pages of content from companies.

Examples include the S&P Global Corporate Sustainability Assessment (also referred to as the Dow Jones Sustainability Index (DJSI)), CDP Climate Change/Water/Forests, Global Real Estate Sustainability Benchmark (GRESB), Workforce Disclosure Initiative (WDI), and Principles for Responsible Investment (PRI) signatory reporting.

Companies opt-in to these surveys. For example, while an organisation like CDP will publish the fact that the company did not respond to invitation to participate, CDP will not go through the company’s climate change disclosure on its own to arrive at a score (unlike ESG ratings providers such as Sustainalytics and MSCI).

A company’s sustainability reporting contributes to its investor survey performance in two key ways:

- Transparency – unlike ESG ratings providers that rely exclusively on public disclosure, companies are able to respond to most investor survey questions with information that is not available in the public domain. However, many of these questions ask companies to support their responses with publicly available evidence. If this evidence is not provided, then the scoring may be impacted or the response to a particular question thrown out altogether. The better the existing reporting, the more likely it will be able to support the investor survey submission.

- Reuse of content – many investor survey questions can be addressed by simply transferring content over from the latest corporate reporting suite. If this reporting is comprehensive, a company will have ready-made answers to help complete the investor surveys. Less comprehensive reporting means a company will need to apply additional effort to research, draft and review its investor survey responses.

If your company wants to benchmark itself and enhance its standing by participating in investor ESG surveys, the survey requirements should be integrated into the annual reporting suite from the beginning of the process. This ensures that the reporting addresses the factors that the investor surveys will cover, and creates efficiencies for your company because the reported content can be used over and over again as needed. Your company will be rewarded for transparency, and will be able to respond to investor surveys (and many other ad hoc investor ESG requests) with ease.

3. Data aggregators

Data aggregators trawl corporate websites and reports, before aggregating information on proprietary platforms and selling access to investors and others. Examples include Refinitiv, ICE Data Services, and Bloomberg Terminal. These aggregators sometimes also include ESG ratings published by ESG ratings providers or investor ESG surveys described above, illustrating one of the many connections between the three categories of services explained in this article.

Companies cannot opt-out of being included in an aggregator’s platform, and the aggregator rarely provides an opportunity for a company to correct any misinterpretations without becoming a paying customer of the aggregator. When this is combined with algorithmic methods to compile company data, it can be hard for a company to engage with an aggregator to understand how it can improve its disclosure.

Furthermore, the ESG ratings providers and investor survey organisations described above are generally set up to consider ESG exclusively. This means they have deep knowledge of how ESG issues impact value creation across industries. In contrast, data aggregators have existed for decades as financial and market data houses, and have incorporated an ESG offer more recently in response to the growing interest from the investment community.

The difficulty in engaging aggregators combined with their relatively recent entry into the ESG space means that they’re less useful for informing corporate sustainability reporting when compared with the ESG ratings providers and investor survey organisations. Nonetheless, they remain users of corporate sustainability reporting and have a wide subscriber base, so it’s worth being aware of their role in the investment landscape.

How can directors and management use ESG ratings to their advantage?

- Reach out to the ESG ratings providers: these providers have company engagement teams who can send you the latest rating report for your company, and set you up on their online portals where you can regularly check your rating and upload new reporting for them to consider.

TOP TIP: Many ratings providers attempt to contact companies through generic email addresses in the first instance (e.g. InvestorRelations@company.com) – search these inboxes for any emails that may have been missed.

- Assess your company’s ESG rating reports for improvement opportunities: review your company’s assessment to complete a gap analysis that identifies areas where your scoring could improve (e.g. your company did not achieve full points for supplier human rights assessments).

TOP TIP: Keep engaging with the ESG ratings providers with any questions you have about the calculations and definitions that they use. Some providers are more responsive than others, but don’t be afraid to follow up – it is in their best interests that they represent your company accurately.

- Decide which gaps could be addressed through better reporting: some of your improvement opportunities will relate to genuine strategic gaps (e.g. you haven’t yet assessed your supply chain for human rights risk), while others will relate to reporting gaps (e.g. you have assessed your supply chain for human rights risk, but have not published a supplier due diligence approach that describes this). Integrating these reporting gaps into your next annual reporting suite will enhance the comprehensiveness of your disclosure and strengthen its alignment with investor interests.

These reporting improvements will positively impact your company’s ESG ratings in the next rating cycle.