What are the ESRS and why do they matter?

The ESRS are a set of reporting standards that define the information most useful for investors, civil society organizations, consumers and other stakeholders to evaluate the sustainability performance of companies. The ESRS have been adopted as part of the European Green Deal, which aims to transform the EU into a more modern and resource efficient economy. By providing a consistent standard for reporting sustainability-related information, the ESRS is intended to foster high quality, reliable corporate reporting.

Many U.S. and other non-EU companies are impacted by the ESRS. Any large company that meets a revenue threshold in the EU, the parent company of a large group, or any company listed on an EU regulated market will be captured by the relevant regulation.

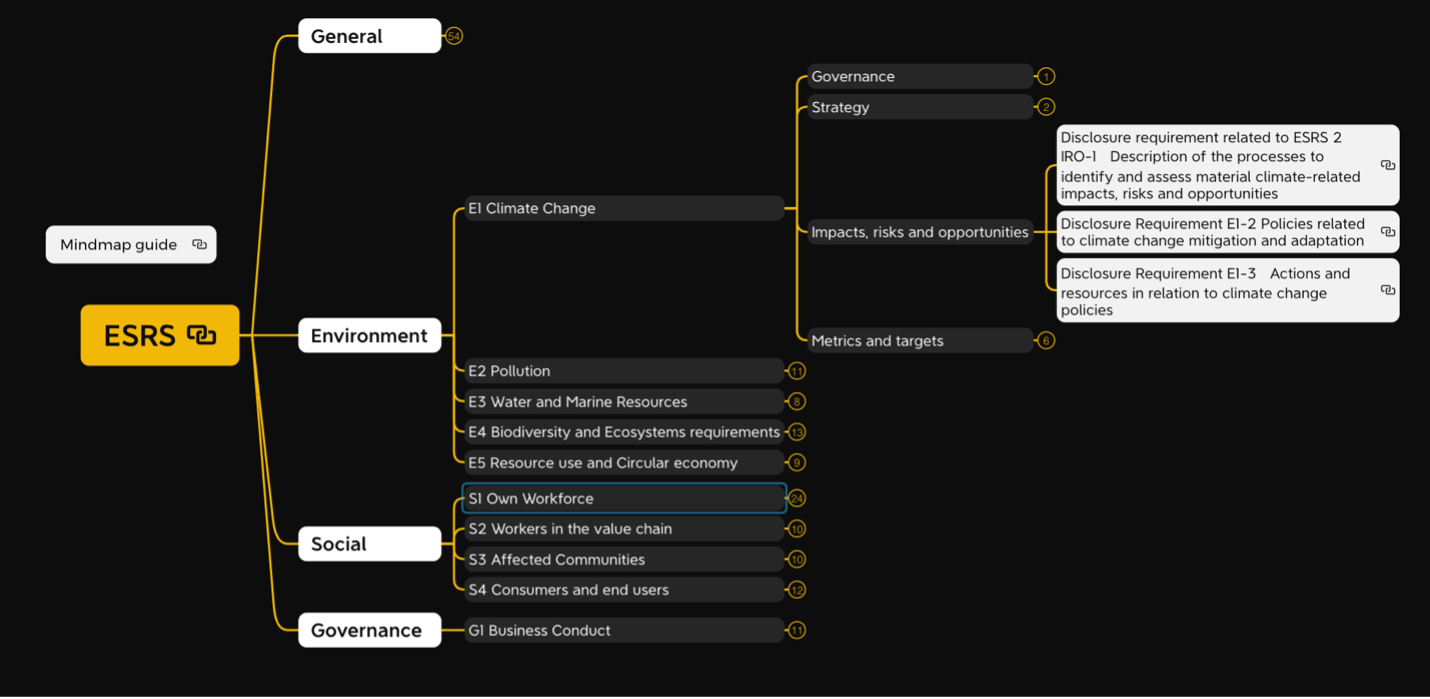

There are a total of 12 ESRS across four categories of disclosures (General, Environmental, Social, Governance). ESRS 1 (General Requirements) lays out principles to be applied while reporting the disclosure requirements in the other 11 ESRS. ESRS 2 (General Disclosures) includes essential information that all in-scope companies need to report, including the process and outcome of the company’s double materiality assessment and information on the company’s risks and opportunities arising from social and environmental issues. Based on the outcomes of the materiality assessment, companies will need to judge the information that is material for them to disclose according to the topic-specific environmental, social, or governance requirements of the other 10 ESRS. The materiality assessment process and the resulting disclosures are all subject to third party assurance.

For more information on the ESRS, including which companies are in scope and when they will need to report this information, see the European Commission’s Corporate Sustainability Reporting web page and Q&A on the adoption of the ESRS.

How to get started

1. Understand the scope of the ESRS using BWD’s free ESRS Explorer

The ESRS Explorer allows users to see disclosure requirements and their accompanying application requirements in a simple, visually appealing format, rather than attempting to digest the ~250-page legal document that contains all the standards. The format of the legal document does not always group requirements together by topic, which is what we’ve done in the ESRS Explorer to make it easier for you to navigate and engage internal stakeholders on the requirements.

Each of the four categories of disclosures are connected to the twelve ESRS, which in turn connect to related disclosure requirements. We recommend that users start by understanding the list of topics covered by the ESRS and their associated disclosure requirements.

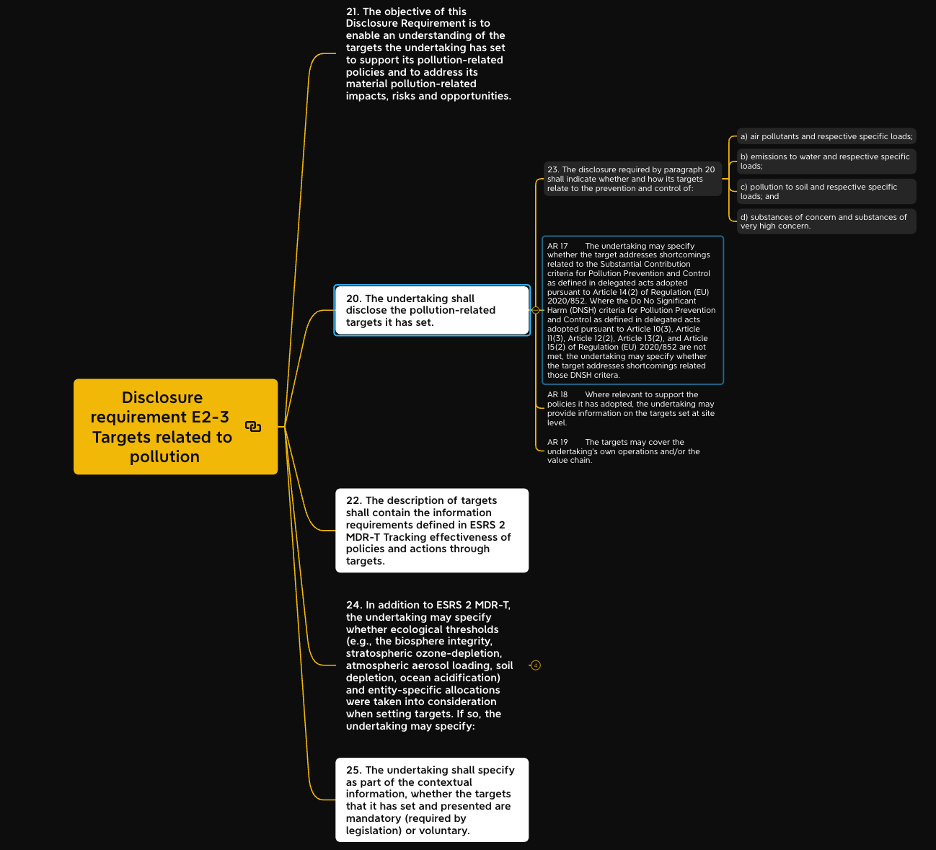

2. Dig deep into the individual disclosure requirements

Once users understand the scope of the ESRS, we recommend diving deep into a few disclosure requirements. Click on the link icon next to each disclosure requirement to be taken to a detailed mind map with the objective of the disclosure requirement, any qualitative and quantitative data that companies will need to report, and guidance for companies to consider.

3. Understand the materiality assessment process

Once you’re familiar with the level of disclosures required, review the materiality assessment requirements. Many companies will need to update their materiality assessments to ensure they identify the ESRS applicable to them.

EFRAG has published draft implementation guidance for the materiality assessment process.

4. Start preparing now

For many large companies with operations in the EU, the ESRS will be required in the coming years. The road to compliance will not be a quick one, and many companies have already started to prepare. For sustainability professionals at impacted companies, the time to start understanding your reporting obligation is now. A suggested work plan for companies required to disclose in 2026 (on the 2025 reporting year):

- ASAP – Update your materiality assessment to comply with ESRS requirements

- Use the 2023 reporting process to identify gaps and engage internal contributors on ESRS requirements

- Use 2024 to agree a content plan for your EU Sustainability Statement

- Use the 2024 reporting process to attempt a “dry run” of your EU Sustainability Statement – address any blocks to having it ready at the same time as your financials, and make sure it is assurance ready

- A dry run disclosure is essential – you can’t wait until 2026 to realize it won’t be ready on time or won’t pass assurance!

- Use 2025 to close any final gaps, enhance processes to facilitate assurance

- Early 2026 – your first EU Sustainability Statement published on time, fully compliant and assured 😊

If you need help understanding your reporting obligations, or need support to implement these recommendations, don’t hesitate to reach out.